Cold Storage Developer

Zero Degrees Capital is a forward-thinking cold storage developer specializing in Build-to-Suit (BTS) developments for tenants across various sectors.

We develop and own state-of-the-art facilities in strategic locations, tailored to the unique needs of each tenant.

Leveraging cutting-edge technology, we provide efficient, sustainable cold storage solutions that meet the specific requirements of industries such as perishable foods, frozen goods, pharmaceuticals, biotechnology, and high-tech electronics.

Our commitment to eco-friendliness and innovation ensures that our facilities align with global sustainability trends, delivering both operational efficiency and environmental responsibility.

What is Cold Storage?

Cold storage refers to the process of storing perishable goods in an environment where the temperature is controlled and kept lower than the standard room temperature. This method is essential for preserving the quality and extending the shelf life of various products, such as food items, pharmaceuticals, and other temperature-sensitive materials. By maintaining a consistently cold environment, cold storage helps prevent spoilage and ensures that these products remain safe and viable for consumption or use over extended periods.

Built-to-Suit Cold Storage Solutions

-

Custom Solutions: At Zero Degrees Capital, we specialize in Build-to-Suit (BTS) cold storage developments, offering custom solutions that align perfectly with the specific requirements of each tenant. Our BTS approach means that we develop state-of-the-art cold storage facilities that are uniquely tailored to meet your operational needs, whether that involves specific temperature zones, advanced logistics capabilities, or specialized storage environments.

-

Strategic Locations: We develop facilities in prime locations that enhance your supply chain, providing proximity to transportation networks and markets critical to your business. Our strategic location planning ensures that your cold storage facility is positioned to optimize your logistics and distribution processes.

-

Tenant-Centric Development Process: We prioritize your input at every stage of the development process to deliver a facility that supports your business operations today and in the future. Our approach focuses on building strong relationships with tenants to ensure that their long-term goals are met through the facility we develop.

Potential Tenants

Our Build-to-Suit cold storage solutions cater to a wide variety of industries with temperature-sensitive needs:

Food & Beverage Manufacturers

Producers of perishable goods like dairy, meats, seafood, fruits, and vegetables.

Pharmaceutical Companies

Firms needing cold storage for medications, vaccines, and other sensitive products.

Third-Party Logistics Providers (3PLs)

Companies managing the storage and transportation of temperature-controlled goods.

Retailers & Grocers

Supermarkets and retailers requiring storage for perishable inventory.

Food Service Distributors

Suppliers to restaurants, hospitals, and food service establishments.

E-commerce Companies

Online grocery and delivery services needing cold storage for perishable items.

Agricultural Cooperatives

Organizations producing and distributing agricultural products.

Biotech Companies

Firms requiring controlled environments for sensitive research and production.

Electronic Components & Devices

Manufacturers and distributors of sensitive electronics needing stable environments.

Renewable Energy Storage

Companies storing batteries for renewable energy systems.

Aerospace & Defense

Producers of temperature-sensitive components like avionics and sensors.

Medical Devices

Manufacturers requiring controlled storage for medical equipment.

Research & Development Laboratories

Labs conducting research on sensitive materials and technologies.

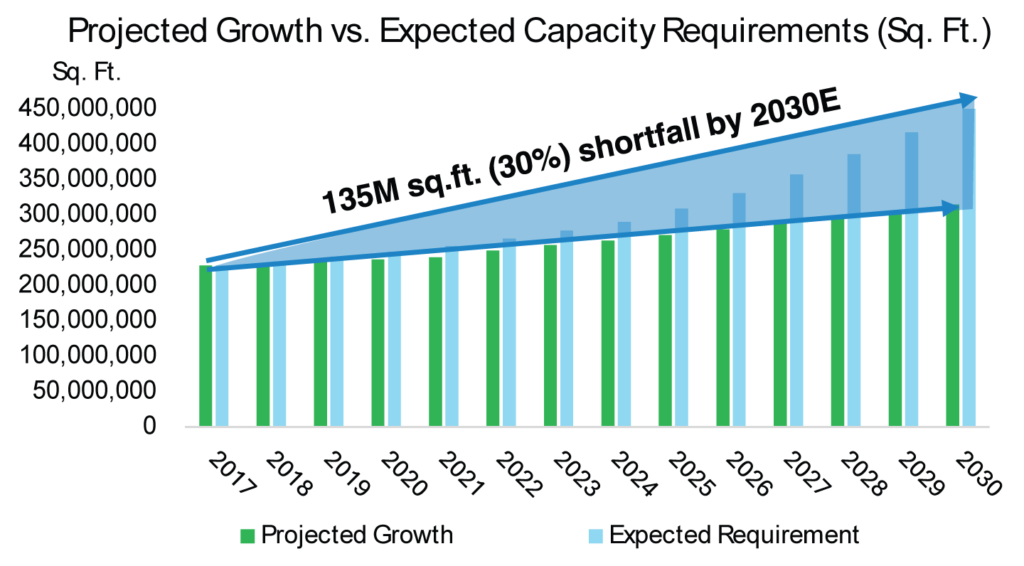

Acute Supply-Demand Imbalance

The growth in sectors requiring cold storage usage is expected to far exceed the estimated growth rate of cold storage facilities, and a continued supply-demand mismatch is expected for the foreseeable future.

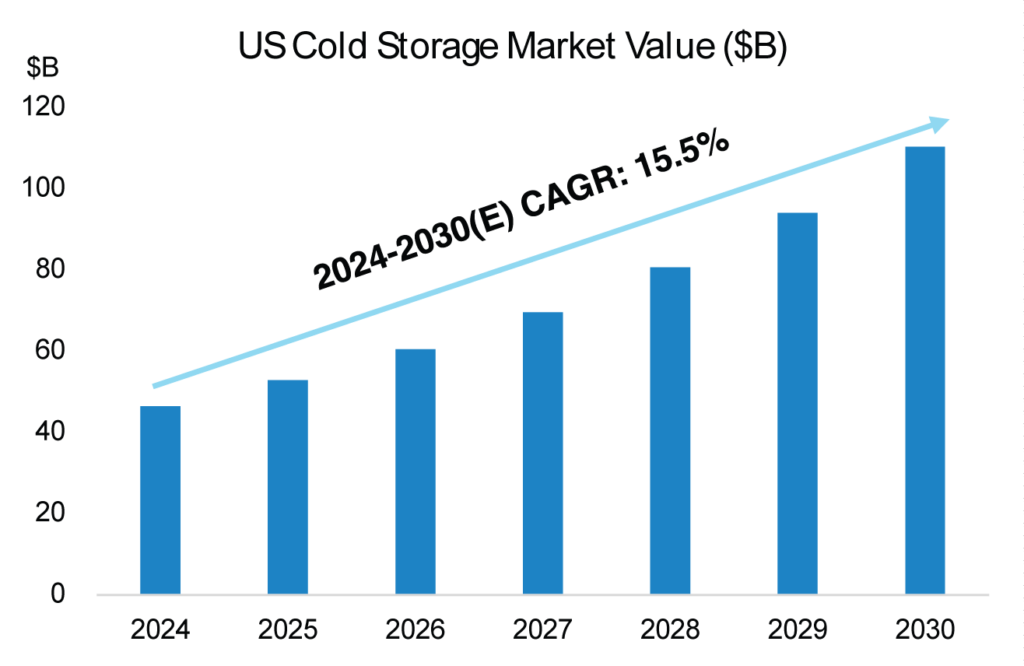

Current market size

The U.S. cold storage market is currently valued at $46.5 billion, covering 265 million square feet.

Future growth projection (supply)

By 2030, the market value is projected to grow to $110 billion, driven by a compound annual growth rate (CAGR) of 15.5%, with the total floor area expanding to 315 million square feet.

Anticipated market need (demand)

By 2030, the market is expected to require 450 million square feet of cold storage.

Supply vs. demand mismatch

Despite the impressive supply-side growth figures, they fall short when compared to the anticipated demand, leading to a significant supply-demand imbalance.

Projected supply shortfall

This supply shortfall is expected to result in a 135 million square feet gap, or roughly 30% less than what is required to meet demand, creating a highly competitive and constrained market.

Growth Drivers

E-COMMERCE EVOLUTION:

Changing consumer behavior and rapid adoption of online shopping for fresh groceries demands robust cold chain solutions to maintain product quality from store to door.

RESHORING:

Bringing food production and manufacturing operations back to U.S. soil increases the demand for cold storage to preserve the integrity of locally produced goods.

SUPPLY CHAIN DYNAMICS:

The expanding global supply chains, driven by growing exports and imports of high-value and processed food items, are creating an urgent need for enhanced cold storage infrastructure to meet rising international and domestic demand.

HEALTHCARE & PHARMACEUTICAL IMPACT:

The development and distribution of temperature-sensitive vaccines, especially during pandemics, highlight the critical role of cold storage in the healthcare industry. The growth of biopharmaceuticals, which often require strict temperature controls, further drives the demand for specialized cold storage solutions.

HIGH-TECH INDUSTRY GROWTH

The growth in industries like semiconductors, batteries, and other high-tech fields is driving increased demand for specialized cold storage solutions, essential for maintaining the stability and optimal performance of these highly temperature-sensitive products.

URBANIZATION:

Growing populations, especially in urban areas, drive higher consumption of perishable goods, leading to greater demand for cold storage facilities to support food supply chains. As more people move to cities, the proximity of cold storage facilities to these urban centers becomes critical for efficient last-mile delivery.

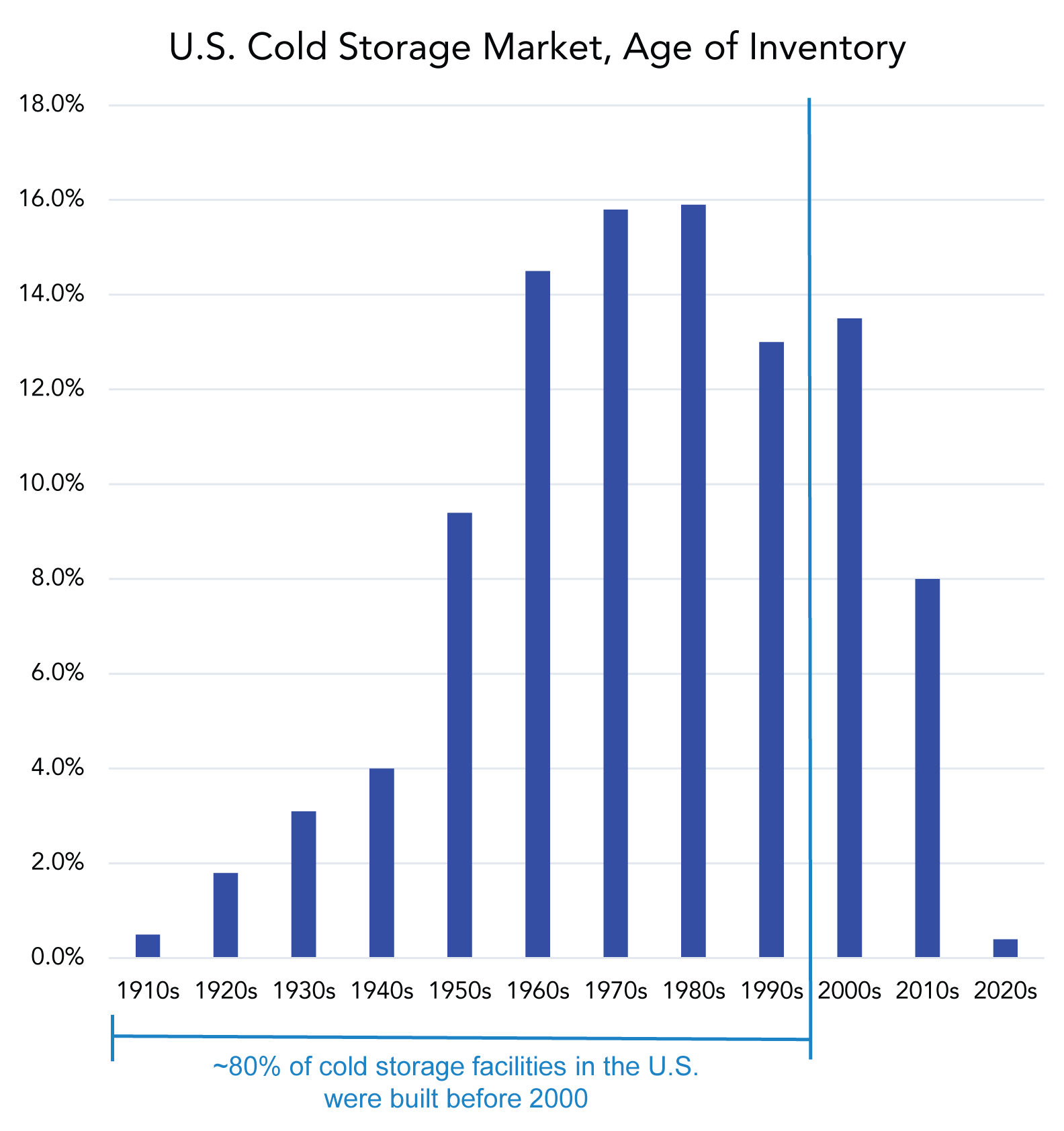

Aging Inventory

-

Current State of Cold Storage Facilities: A significant portion of the cold storage infrastructure in the United States is outdated, with the average facility being older than 40 years old. Approximately 80% of cold storage facilities in the U.S. were built before 2000.

-

Inefficiencies and High Operating Costs: Older cold storage facilities typically suffer from inefficiencies such as poor insulation, outdated refrigeration systems, low ceilings, and inadequate temperature control. These inefficiencies result in higher energy consumption, increased maintenance costs, and greater risk of temperature fluctuations that can compromise the quality and safety of stored products.

-

Increased Risk of Product Spoilage: As cold storage facilities age, the risk of equipment failure and temperature inconsistencies grows. This not only threatens the integrity of perishable goods but also increases the likelihood of product spoilage, leading to potential financial losses for businesses relying on these facilities.

-

Need for Modernization: To keep pace with the growing demand for temperature-sensitive logistics, there is an urgent need to modernize existing cold storage facilities. However, due to the limitations of retrofitting older structures, building new, state-of-the-art facilities often becomes the only viable option.

-

Declining Overall Capacity According to the USDA, there’s been a reduction in overall usable cold storage capacity, dropping by 1.2% from 2021 to 2023, primarily due to the combination of aging infrastructure and insufficient new construction.

Contact Us